Bitcoin's Long Game Begins This Summer

Bitcoin enters DeFi with sustainable utility—leaving behind the chaos of past DeFi Summers. BTCFi Summer has finally arrived.

Bitcoin enters DeFi, offering sustainable utility rather than the speculative chaos of previous DeFi Summers.

What DeFi Summer Actually Means

In crypto, "summer" signals explosive growth and unprecedented activity. The original DeFi Summer of 2020 saw users chase insane yields, swap governance tokens, and live on Discord watching positions. Everyone remembers the headlines: thousand percent returns, new millionaires daily, the future of finance being built in real-time.

But here's what nobody discusses: the exhaustion that came with those gains. Constant monitoring meant setting alarms for 3am protocol launches. Gas fees destroying capital efficiency turned profitable trades into losses. Protocol hopping became a full-time job, and smart contract exploits claimed millions while you slept. As Entrepreneur documented, participants managed positions minute by minute, jumping between whatever launched that day, hoping they weren't the exit liquidity.

BTCFi Summer transforms this entire paradigm.

This Summer's Forecast: BitcoinFi

What if you could access DeFi without buying a single memecoin, governance token, or food-themed experiment?Your Bitcoin unlocks DeFi utility. No COMP tokens. No SUSHI swaps. No Magic Internet Money disasters. Just Bitcoin accessing real protocols through tBTC.The data confirms the shift. Bitcoin in DeFi exploded from practically nothing to $6.5 billion last year (BeInCrypto). With tBTC live across major DeFi protocols, institutions are finally discovering how to put Bitcoin to work.

From Vault to Value

To understand the significance of BTCFi Summer, consider how assets evolve over time. Every productive asset in history follows a similar path from static to dynamic, and Bitcoin's journey mirrors this perfectly:

Gold Era: Physical gold, typically held in vaults or personal safes, offered maximum security and served as a store of value. However, it lacked liquidity and utility — it couldn’t earn yield, be easily transferred, or integrated into broader financial systems. Your wealth was secure, but largely idle and illiquid.

Paper Gold: Paper gold emerged in the form of gold certificates, futures contracts, and later ETFs (e.g., SPDR Gold Shares), allowing investors to gain exposure to gold without physically holding it. While it improved liquidity and accessibility, the gold itself remained passive — not used in productive financial applications. Easier to trade and store, but still not capital-efficient.

Financial Products: With the growth of financial markets, gold has begun to be integrated into complex financial instruments, including options, futures, swaps, and gold-backed loans. These enabled investors to earn yield, hedge exposure, and use gold as collateral — transforming it from a static asset to a functional part of the financial system. Gold became productive, with the same ounce potentially serving multiple financial roles.

Bitcoin's following the exact same playbook:

First came the security-maximalist phase, where cold storage and hardware wallets were considered the only acceptable way to hold BTC — prioritizing self-custody and immutability above all else.

Then came the convenience phase, marked by the rise of custodial solutions like ETFs, which now hold billions in BTC. While they offer institutional access and price exposure, these holdings remain largely idle, not participating in any productive financial activity. Now we're at the obvious question: Why is Bitcoin the only asset in your portfolio that doesn't work?

Active Trading vs Strategic Investment

Traditional DeFi summers demand constant attention. BTCFi Summer rewards strategic laziness:

🌾DeFi Summer (2020):

- Daily yield hunting across multiple protocols

- Frequent fund movements chasing the highest APY (often with gas fees exceeding $100)

- New farms launched mid-day, prompting rapid user inflows

- Yields collapsed by evening, triggering constant reallocation

- A cycle of high activity, high risk, and burnout

🟠 BTCFi Summer (Today):

- Bridge Bitcoin once via tBTC

- Access diversified and sustainable DeFi strategies

- Minimal maintenance — check performance quarterly if needed

- Protocols automate yield generation and risk management

- A more mature, efficient, and user-friendly experience for Bitcoin holders

The difference? Set it and forget it beats frantic trading.

Security Architecture: The Technical Foundation

During the height of DeFi Summer in 2020, protocol exploits and hacks occurred almost weekly. According to DefiLlama, over $2.88 billion has been stolen from bridge protocols alone.BTCFi Summer is built differently.

Threshold Network leverages threshold cryptography to eliminate single points of failure. Instead of one entity holding full control, funds are only accessible through a decentralized coordination of 51 out of 100 independent participants — significantly increasing security and resilience.

The result? A zero-incident track record. Threshold’s infrastructure has been live for years, successfully withstanding every known attack vector. It offers users a robust, battle-tested foundation for interacting with Bitcoin in DeFi.

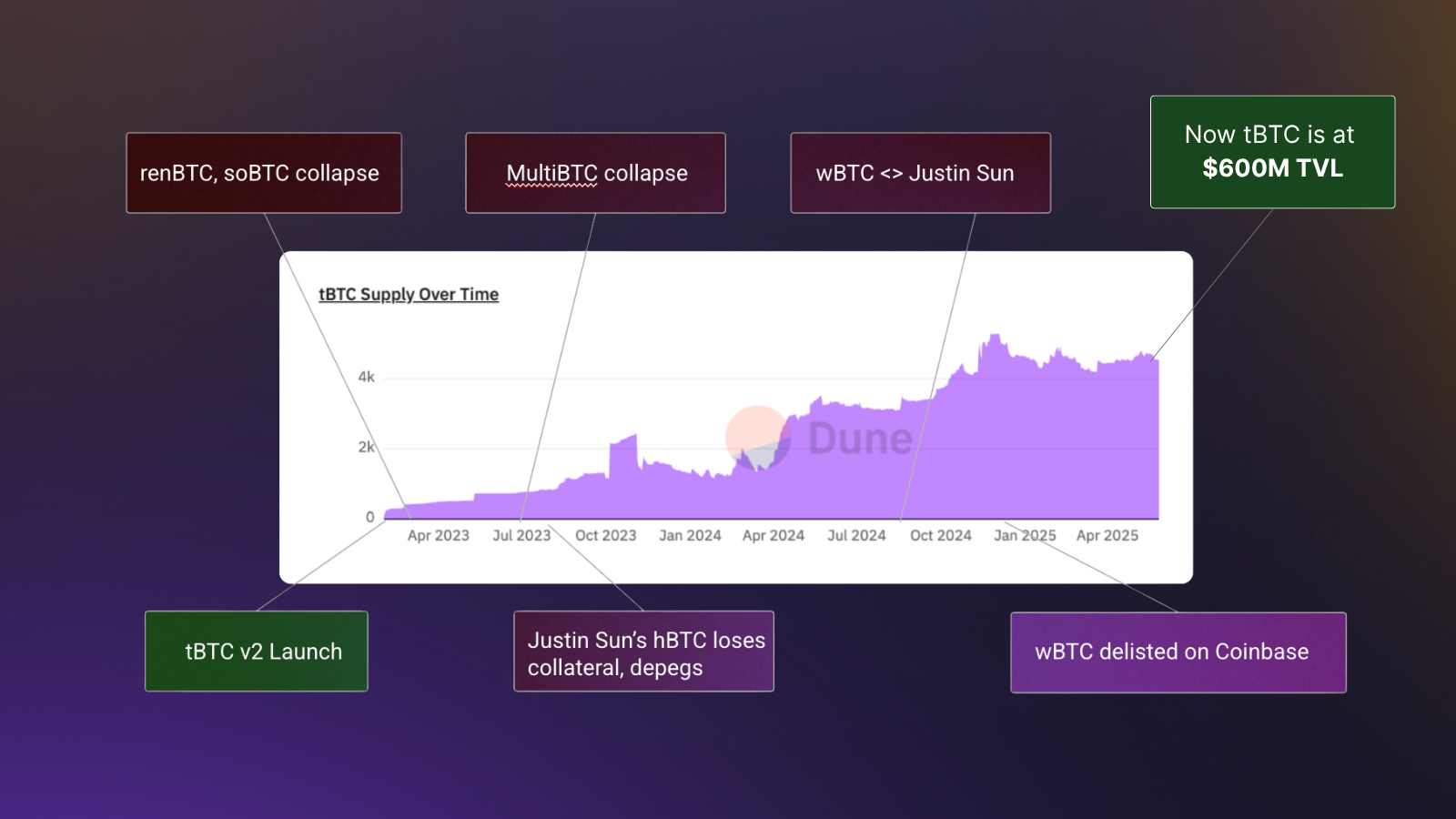

Here’s a brief timeline highlighting other projects that failed — while tBTC steadily grew stronger over time.

Where Do You Fit in BTCFi Summer?

Missed DeFi Summer 2020? Consider yourself fortunate: You avoided unsustainable 52,000% APYs, failed food tokens, and gas fees that often exceeded the value of the transaction itself.

BTCFi Summer is just built differently: It offers sustainable access to DeFi — without the chaos. No hype cycles, no casino dynamics. Just sound infrastructure enabling Bitcoin to do more.

Still evaluating? The infrastructure is already live, secure, and proven. Threshold Network has consistently demonstrated its resilience and reliability across market cycles.

- Millions in value moved.

- Zero security incidents.

- Multi-chain integrations.

This is no longer an experiment — it’s an ecosystem built for long-term use.

Already participating? Then you understand the opportunity. The real question now is: How much more idle Bitcoin could be working for you?Here are a few pool options to help you get started:

- BLUEFIN : [click here]

- BUCKET: [click here]

- ALPHALEND: [click here]

- MEZO: [click here]

- GEARBOX: [click here]

- NERITE: [click here]

A Window of Strategic Advantage

Bloomberg dubbed 2024 “DeFi Summer 2.0” — a signal that yields have returned to the ecosystem.

But for most participants, those yields still come at a cost: managing dozens of tokens, switching platforms, and staying glued to Discord at 3 a.m.BTCFi Summer takes a different approach.

With tBTC, Bitcoin holders can access DeFi’s full toolkit — without the noise. No more chasing unsustainable yields or monitoring Telegram threads. Just Bitcoin, finally participating in finance like any other onchain asset.

The infrastructure is live across major chains. The security model is battle-tested. The strategies are working — without needing constant oversight or permission from a third party.

BitcoinFi Summer:

Where Bitcoin finally becomes productive, powered by tBTC.

Disclaimer: The information provided is for educational purposes only and does not constitute financial, investment, or legal advice. Investing in cryptocurrency and digital assets involves a high degree of risk. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.