Reclaiming the Term ‘Decentralization’

There are two fundamental components to decentralization: Resiliency, and Losing the Power to Censor.

A guest opinion piece by Threshold's Marketing Guild

Something changed, slowly but surely, to the term ‘cheater’ over the course of the centuries. Originally, the word ‘cheater’ used to refer to something quite technical and specific; namely; a particular Royal Office. In the 14th century, a “cheater”, or “escheater” was someone in charge of the king’s escheats; land that would revert in ownership to the crown, in certain cases of succession, when an owner died without clear, legal heirs.

It’s probably easy enough to see why this word has evolved the way in which it has; with today’s definition being “a deceptive person unworthy of trust.” Apparently, escheaters had quite the reputation for unscrupulousness, and for bending the laws in ways that would favor the king.

There is a similar, entropic effect impacting the twenty-first century world of DeFi - and one that is happening far more rapidly - to our use of the term “decentralized.” Inevitably, language evolves and the meaning ascribed to words changes over time, and while it is fairly benign that the term ‘cheater’ no longer applies to a specific occupation, but rather now, to someone’s behavior, what has been happening to ‘decentralization’ has more negative consequences.

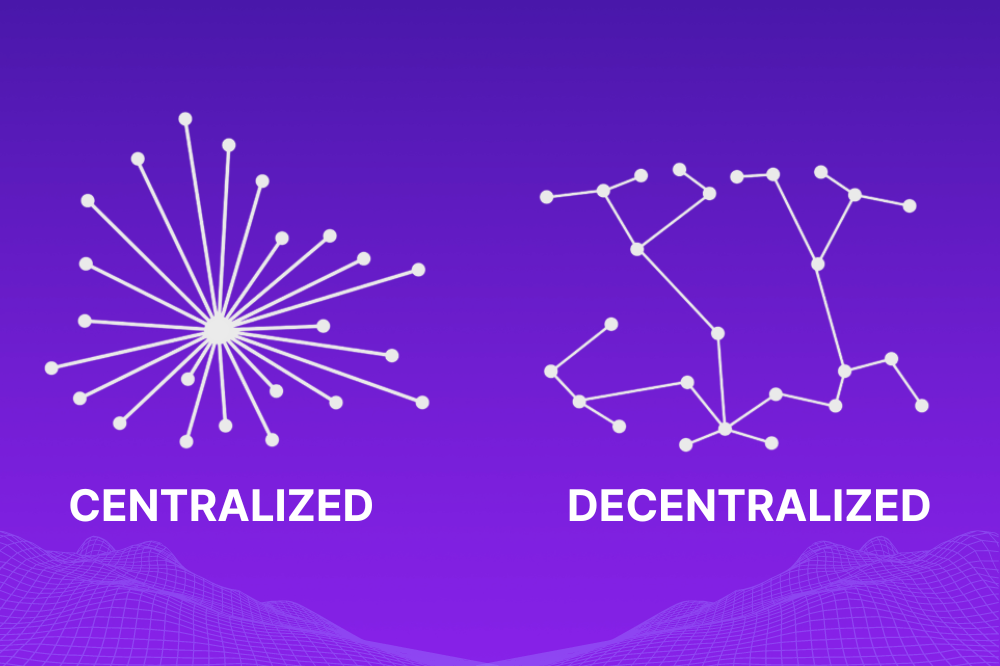

‘Decentralization,’ as it was originally applied to the world of cryptography and blockchain technology, stuck closely to the dictionary definition of the word:

“To undergo redistribution or dispersal away from a central location or authority.”

In other words, decentralization, when it came to finance, referred to the fact that there was no centralized custody of assets, such as is the case, for example, with a bank.

Today, however, ‘decentralized’ has begun to stand for something else entirely; something far more vague and amorphous. Despite the hype and buzz surrounding the word, now ‘decentralized’ seems to simply refer to ‘any platform built on Web3 or blockchain that has complexity and is difficult to understand.”

This casual usage of ‘decentralized’ carries with it many risks, the worst of which is missing the point of what was so important and revolutionary about DeFi in the first place; it obfuscates what actually determines if something is truly decentralized, why decentralization is desirable, and how to know it when you actually have it.

There are two fundamental components to decentralization: Resiliency, and Losing the Power to Censor.

Resiliency

Resiliency means that there is not any single, centralized entity that has the ability to simply say ‘we are done’, shut down the game, and walk away from the table. The power to continue on has to be in the hands of a multitude of parties who are able to keep things going.

Take, as an example, WBTC: they are a centralized service. If they decide to shut off their bridge, then all of the WBTC assets on Ethereum will become unredeemable.

In addition, if WBTC wants to keep running their bridge, but wants to block you, specifically, from being able to go back and forth over their bridge, they have the power to do so. And so, not only does WBTC lack resilience, but you as a user lack resilience, should they decide to limit your activity; which brings us to the second, fundamental ingredient for decentralization:

Losing the Power to Censor

The true benefit to decentralization is that power, whether it be the power to shut things down completely, or the power to censor particular individuals, is placed in the hands of the many, as opposed to a single, central authority. Even if a particular wallet on TBTC v2 or v1 wants to block you from redeeming, they may do so. You can’t stop them. However, there are a multitude of wallets all operating on the network at the same time. So, if one wallet decides to censor you, you can simply just go to another wallet, and redeem. The power to censor anyone and everyone is never centralized.

The only way in which anyone can ever be ‘fully censored’ in a truly decentralized system, is if everyone decided to censor you at once; which is completely distinct from what happens in a centralized system, wherein a central body decides.

People are beginning to lose sight of these core features of what defines decentralization. If you mention ‘decentralized finance’ to a newcomer, or to anyone unfamiliar with this space, a more and more common response you will hear is “Oh, you mean like Bitcoin and Ethereum?”

Decentralization is more complicated than that. While cryptocurrency may have begun as something synonymous with decentralization when it first appeared, when it was considered the new ‘Wild West’ or ‘The New Frontier’, today plenty of DeFi platforms have settled the land, established townships, set up saloons and Sheriff’s departments, and, most importantly, opened up banks!

In conclusion: resiliency, and censorship resistance; if your ‘decentralized’ system is not accomplishing those two things… It's cheating.