Setting the Bitcoin Standard: What's next for Threshold Network and tBTC?

We’ve been here since the beginning, and we have consistently stayed true to our core belief that Bitcoin deserves more than storage and speculation. Here is what we will do next | Threshold

Over the past few months, you may have noticed a shift in how we show up, not just in what we build, but how we talk about it.

This didn’t happen overnight. It was the result of months of conversation, debate, and alignment within the DAO — all grounded in one question: how do we stay true to Bitcoin while helping it move forward?

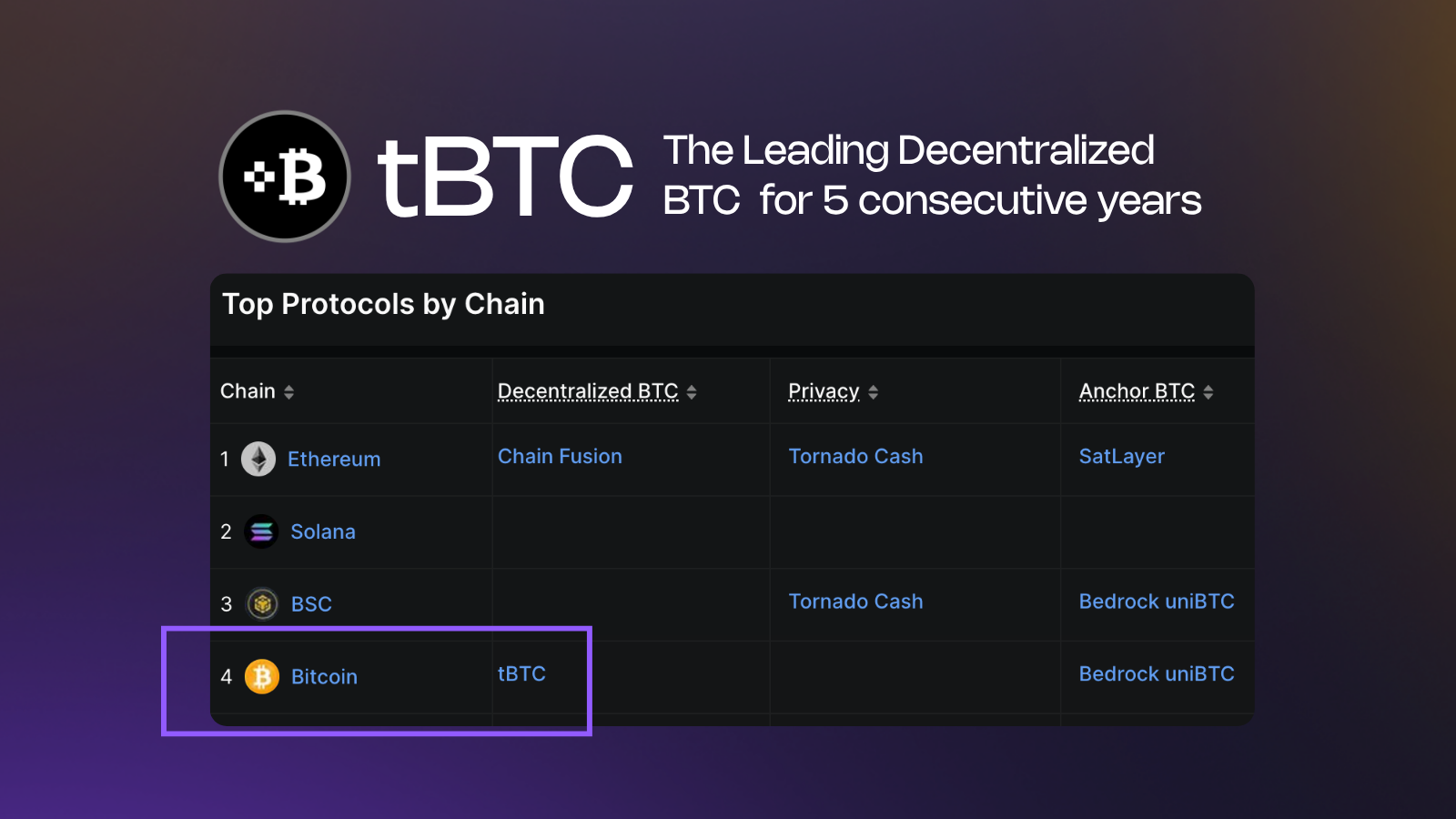

As we enter what many call the “Bitcoin Hypercycle,” countless new projects are emerging, each vying for a piece of the momentum. But Threshold isn’t new to this. We’ve been here since the beginning, and we have beaten all the odds, as we have consistently stayed true to our core belief that Bitcoin deserves more than storage and speculation.

Since 2020, we’ve worked to unlock its potential while fiercely protecting the values that make it what it is: trust-minimized, secure, and sovereign. No added gimmicks, just real liquid Bitcoin Onchain.

That belief hasn’t changed, and we have restructured to build on that belief even further. Threshold Network is no longer spread across many fronts. We’ve sharpened our focus into a singular mission: to make tBTC the dominant, decentralized, cross-chain liquidity rail for Bitcoin in DeFi. This isn’t just a pivot — it’s a commitment to go all in on what we believe matters most.

This article is a reflection of that shift. It explains where we’re going, why it matters, and how we’ll get there. No corporate buzzwords. No fluff. Just the honest story of how Threshold found its edge — and how we’re using it to build something Bitcoin can finally move through.

Genesis Mode: The Swiss Army Knife Era

Threshold was born from a vision of integration and synergy. Created through the groundbreaking merger of Keep and NuCypher in 2021, Threshold pioneered a bold approach: building multiple threshold cryptography applications under unified governance:

- tBTC: The most decentralized Bitcoin Onchain

- TACo: Threshold Access Control for Decentralized Data Sharing

- thUSD: A BTC/ETH-backed stablecoin

- Various other initiatives: Each leveraging shared cryptographic infrastructure

This diversified strategy aligned with bull market expansion thinking but created three key challenges as the market matured:

Strategic Catalysts in the DAO landscape

1. Resource Allocation Efficiency: By 2024, Threshold was allocating $1.5 million annually to operational overhead across multiple product lines, a common challenge for expanding DAOs. What works during growth phases often becomes suboptimal during periods of market consolidation.

2. Market Positioning Clarity: As tBTC demonstrated increasing product-market fit, our multi-product communication strategy created natural positioning challenges. Clear, focused messaging is increasingly becoming crucial in the current market.

3. Tokenomic Sustainability: T token staking emissions effectively bootstrapped network security, but like many maturing protocols, Threshold needed to evolve toward an economics model aligned with sustainable growth rather than initial network bootstrapping.

We're Not Alone: The DAO Evolution Wave

Threshold's transformation isn't happening in isolation. Across the crypto landscape, DAOs are abandoning the free-spending, multi-project frameworks to align incentives with revenue mechanisms, as shown in the illustration below:

Evolution of DAOs (illustration)The bear market imposed a discipline that bull markets never require. It's not just a trend; it's natural selection in the protocol ecosystem. Projects that emerge from this evolution are leaner but stronger, with clarity of purpose and sustainable operations.

Formalizing Focus: The Architecture of Scale or “The Precision Framework”

In early 2025, the community implemented the Threshold Improvement Proposal (TIP-100 and TIP-103). Creating a strategic framework for accelerated growth:

- Strategic Focus: Threshold Labs is given resources by the DAO to make tBTC the premier trust-minimized Bitcoin liquidity hub for DeFi.

- Precise Governance Restructuring: TIP-103 formalized this restructuring by establishing the Threshold Committee. This is a combination of the previous Treasury Committee and Council, consisting of 6 part-time paid seats and three volunteer seats with a 5-of-9 multisig threshold. This maintains security while reducing annual governance costs by ~$1.1 million.

- Product Evolution: Transitioning non-core products like TACo to independent networks and suspending thUSD incentives, and later TIP-102 putting thUSD into "maintenance mode", to enable complete focus on tBTC.

- tBTC Appchain Development: Building a dedicated blockchain infrastructure explicitly optimized for Bitcoin bridge functionality and cross-chain integration.

TIP-100 established a strategic division of responsibilities: Threshold Labs operates as a lean startup focused exclusively on tBTC development and growth, while the DAO maintains critical governance functions.

Rather than simply delegating execution, this created two complementary entities with aligned missions but different operational models: bringing startup agility to product development while ensuring robust grassroots community governance.

Maturing With the Market: Why Bitcoin DeFi is more critical now than ever

The external opportunity for Threshold is expanding dramatically, yet most of this activity happens through centralized or semi-centralized bridges: exactly what tBTC is designed to replace.

- The DAO Evolution Pattern: Threshold's strategic focus reflects a broader pattern in the maturing DAO ecosystem. Projects like MakerDAO, Optimism, and Lido have similarly refined their governance and focus as the market has evolved from expansion to efficiency.

- The Bitcoin DeFi Renaissance: Simultaneously, Bitcoin DeFi is experiencing unprecedented growth, with TVL rising over 2,000% in 2024 alone (from ~$300M to $6.5B). This surge creates perfect timing for a focused Bitcoin liquidity protocol; an opportunity that demands Threshold's complete attention. By focusing entirely on tBTC, Threshold is positioning itself to capture this growing demand at precisely the right moment.

Strategy to Shipping: What's Up Ahead

With strategic clarity established, Threshold's new roadmap can be read in the following proposals:

- TIP-100: The Future of Threshold

- TIP-98: The Initial Vision for Restructuring

- TIP-092: Make T Great Again, Part 1 (Eliminate Inflation)

The DAO's restructured finances project a ~23-month runway for stablecoin obligations, with $10.6M in T tokens held against annual protocol and incentives costs of $2.8M. This conservative financial planning ensures long-term sustainability while enabling strategic resource allocation to tBTC development.

A More Aligned, Agile Threshold

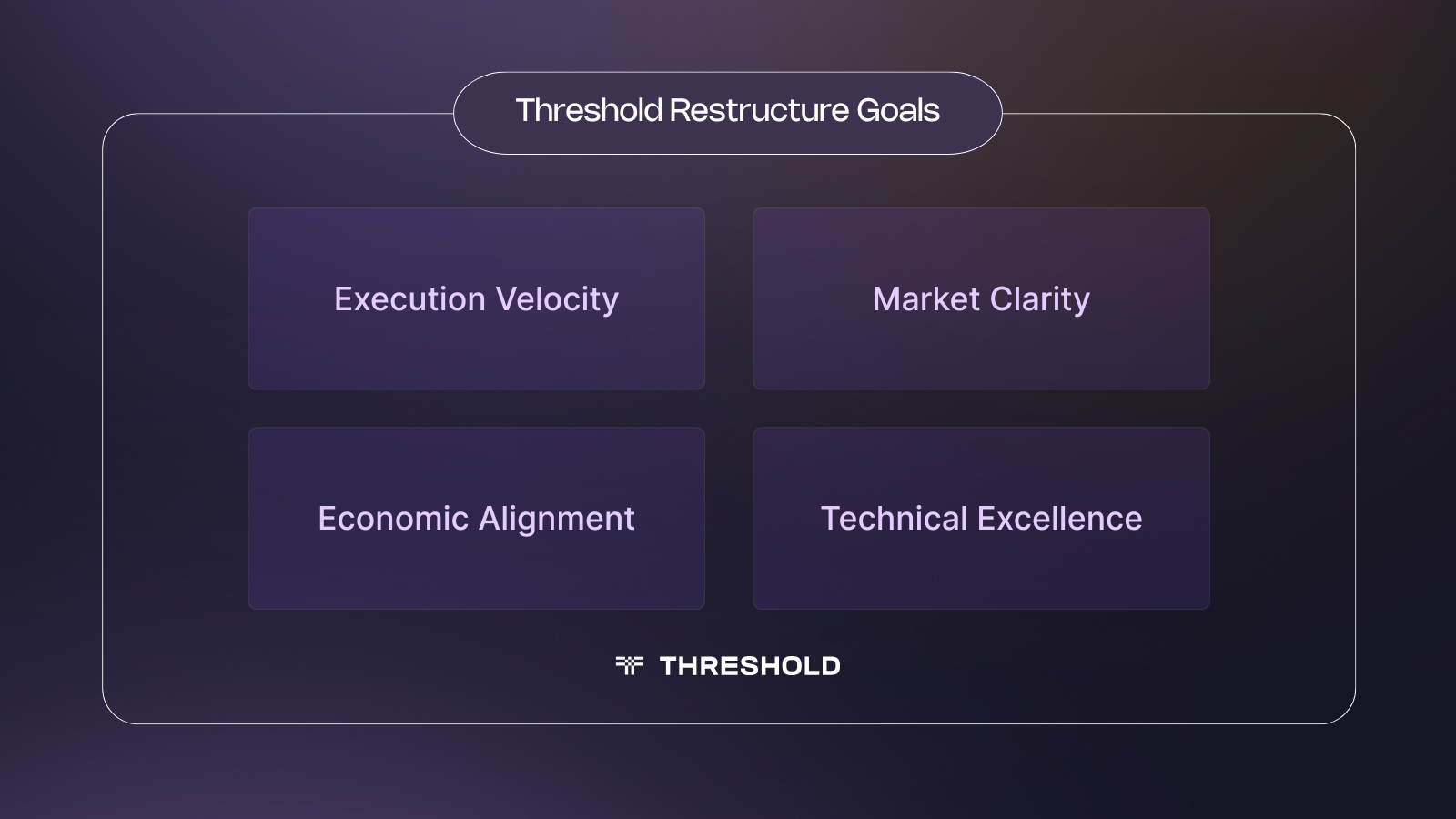

This evolution delivers four key advantages:

- Execution Velocity: Streamlined governance enables faster technical development, integrations, and partner onboarding.

- Market Clarity: A single-product focus creates unmistakable positioning, simplified messaging, and stronger partnerships.

- Economic Alignment: Sustainable tokenomics creates structural alignment between tBTC adoption and T token value.

- Technical Excellence: Concentrated engineering resources enable faster innovation and better security for tBTC.

Complementary Organizational Models: The restructuring creates specialized entities for different functions: Threshold Labs brings a startup-style focus and agility to product development and growth, while the streamlined DAO governance (through the Threshold Committee) maintains robust community oversight, treasury management, and security functions.

The Next Phase for Threshold and tBTC is on the Horizon

Threshold DAO has embraced the natural evolution that successful protocols must undergo. By choosing strategic focus over diversification, sustainable economics over bootstrapping incentives, and execution excellence over exploration, we've positioned ourselves to lead in the rapidly expanding Bitcoin DeFi landscape.

This transformation represents the maturation of Threshold, a transition from the experimentation phase to targeted execution. It meant making tough choices about promising projects, refining our operational structure and aligning around our demonstrated strengths.

The result is an organization precision-tuned to achieve what matters most: bringing Bitcoin's massive liquidity into DeFi without compromising on decentralization or security.

The strategically focused Threshold DAO is now positioned to deliver on its core promise. No unnecessary complexity, no diluted efforts, just a clear mission and the optimized structure to achieve it.

By focusing our resources on tBTC, we've created the organizational clarity and execution velocity needed to compete in the current market demand. The leaner, focused Threshold is now optimized to deliver on its original promise.

For five years, Threshold Network has stood for what Bitcoin truly represents: trust-minimized, permissionless, and resilient. We’re not chasing trends — we’re building the future. Threshold Labs is here to carry that momentum forward, stronger than ever.

No shortcuts. No noise. No gimmicks.

Just setting the right Bitcoin standard onchain....

And we’re only getting started.