tBTC–MUSD Pool Goes Live on Merkl

Liquidity provision has been a central mechanism in decentralized finance (DeFi), establishing the foundation for efficient markets and permissionless trading. From the introduction of automated market makers, liquidity pools have become a recognized infrastructure layer for digital assets. The launch of tBTC-MUSD (@MezoNetwork) pool on Uniswap V4, accessible via Merkl, represents a structured opportunity within this framework. With a defined incentive program and a narrow fee tier, the pool supports increased Bitcoin utility in DeFi while operating in line with established market practices.

What is this opportunity?

Merkl is offering a liquidity-incentivized campaign, allowing users to supply liquidity to the tBTC-MUSD pool on Ethereum under Uniswap V4, with extremely tight fees (0.05%). The pair is between tBTC (a tokenized Bitcoin on Ethereum) and MUSD (a stablecoin or USD-pegged token in this context). The pool has a very narrow fee tier, which is designed to minimize slippage and make swaps cheaper for traders, but also means liquidity providers (LPs) need to be more precise in positioning.

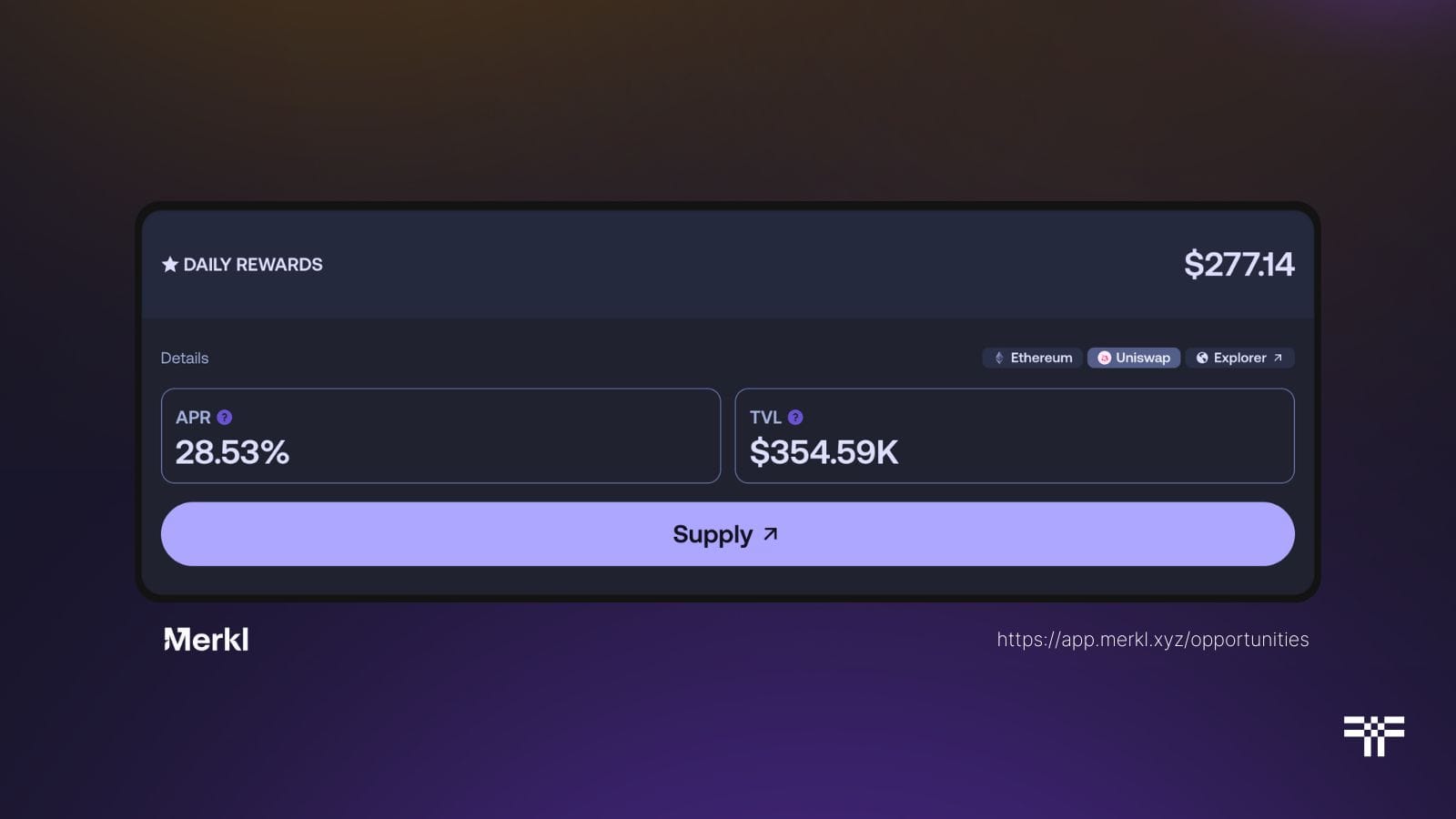

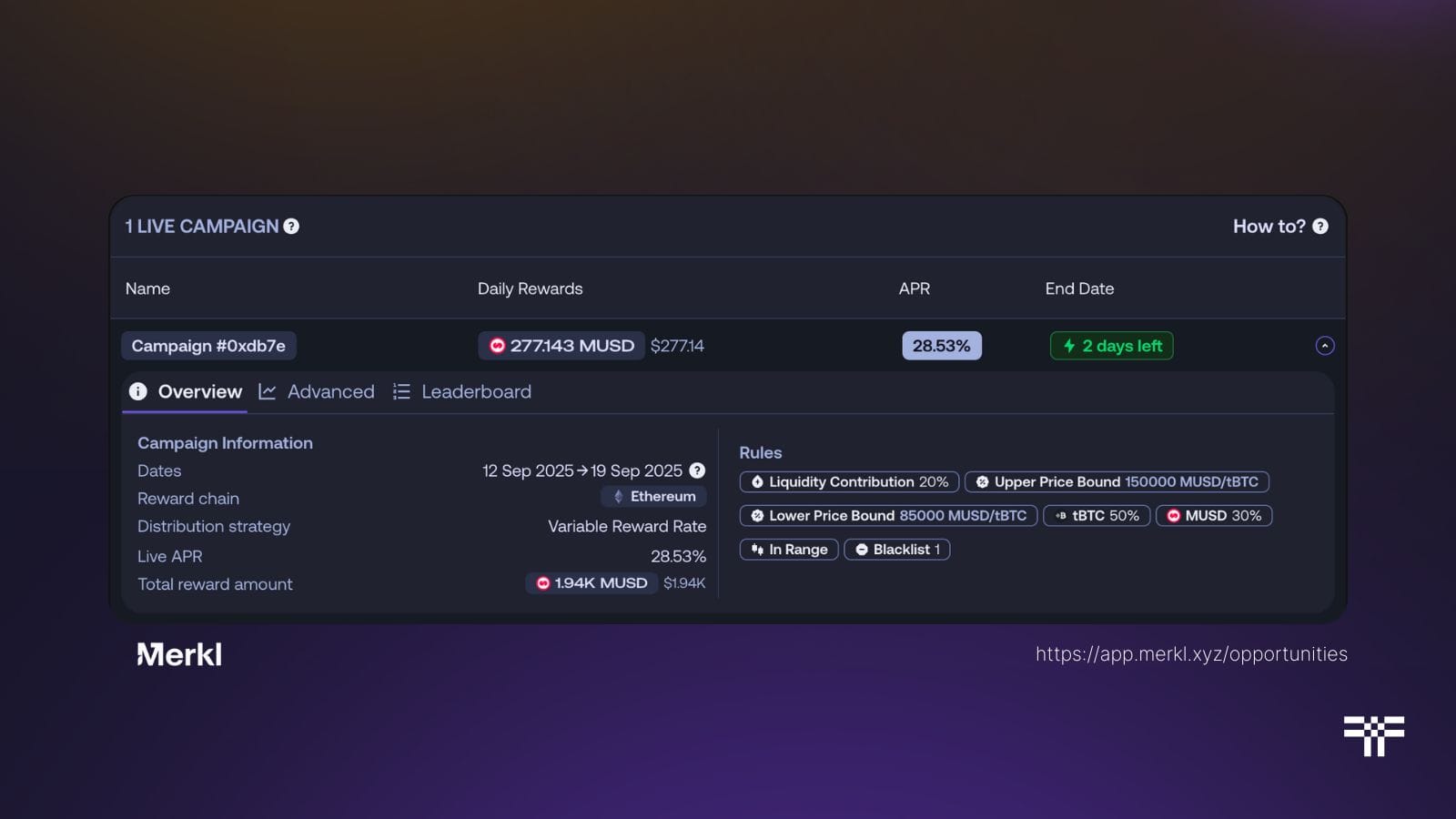

Here are the key stats:

- APR: 28.5%, a relatively high reward rate, though subject to fluctuation depending on utilization and token prices. (Merkl)

- TVL (Total Value Locked) is about $355K; this is the liquidity currently in the pool. (Merkl)

- Daily Rewards: about $277 designated for participants in the campaign. (Merkl)

- Campaign Duration: From 11 September 2025 through 18 September 2025, only a few days remaining at the time of writing. (Merkl)

How it works / Terms to know

To take part, you need to supply liquidity to this specific pool within certain bounds. The pool has specified lower and upper price bounds: between 85,000 MUSD/tBTC and 150,000 MUSD/tBTC. This means your liquidity must lie within that price range to be “active” and generate fees (and rewards). Liquidity outside the price band won’t capture the same benefits until price returns to the band.

Another component is the “Liquidity Contribution” structure of the campaign: LPs are judged based on how much of their liquidity is within-range. For example, to score full rewards, 20% (or ratio) of your provided liquidity must remain active (i.e., within the bounds). Portions outside the bounds are essentially dormant until the price moves back.

Risks and considerations

While the 28.5% APR is attractive, participants should also be mindful that yield opportunities in DeFi are not without trade-offs. Factors such as liquidity conditions, market volatility, and smart contract exposure can influence actual returns. As with any DeFi position, staying informed and exercising risk awareness is essential. Here are some associated risks in participating in DeFi pools:

- Price-Bound Risk: If the market price drifts outside the specified bounds, your liquidity may become inactive (i.e. not capturing fees or rewards) until prices return. You’re exposed to gains and losses across that spread.

- Reward Volatility: The actual realized APR depends on the usage of the pool (how many trades happen), how much of your capital remains active, and the token prices themselves. If trade volume drops, revenues drop.

- Smart-contract / platform risk: As with any DeFi opportunity, participants should remain mindful of standard considerations such as smart contract exposure, bugs, or market slippage.

Is it worth it?

If you are moderately risk-tolerant, believe that tBTC’s price will stay within or oscillate through the 85,000–150,000 MUSD range, and want exposure to high APRs, this opportunity can make sense. For those seeking more stability or less active management, the risk of being out of range or facing impermanent loss might not be ideal.

If you want to explore pool yields while sticking to Bitcoin-based options onchain, you can look into our other available pools such as:

Finding Value in Liquidity Provision

The tBTC-MUSD Uniswap V4 pool via Merkl provides a compelling chance to access high yields in DeFi, with transparent parameters and a solid reward structure. But it’s not “set it and forget it”: success hinges on understanding the dynamics of liquidity provisioning, staying aware of price movements, and being ready for volatility.

If you decide to participate, consider only allocating what you are comfortable managing and potentially rebalancing as needed. With that, you could leverage your capital in DeFi more efficiently while enjoying elevated rewards.

About Threshold Network

Threshold Network powers tBTC, the leading 1:1 Bitcoin-backed, decentralized wrapped Bitcoin for DeFi. Secured by a 51-of-100 threshold signer model, tBTC delivers true decentralization and is the most trust-minimized and liquid Bitcoin asset onchain with no custodians or compromises. Learn more: https://threshold.network