tBTC Now Live on Aave v3 Base and Arbitrum

Threshold Network has reached a significant milestone in its mission to bring Bitcoin into onchain markets: tBTC is now live on Aave v3 Base and Aave v3 Arbitrum.

Following the strong adoption of tBTC on Aave v3 Ethereum, these new integrations extend Aave’s access to secure, permissionless Bitcoin liquidity across two of the fastest-growing ecosystems. For BTC holders, this unlocks more flexibility, deeper liquidity, and new ways to unlock bitcoin in broader financial markets.

Building on Proven Demand: Ethereum as a Foundation

The story began with tBTC’s launch on Aave v3 Ethereum in early 2024. Demand was immediate:

the initial 500 tBTC supply cap was reached within a week, and the limit has since been raised several times, most recently to 2,600 tBTC.

Today, thousands of tBTC are deployed on Aave Ethereum, where they provide liquidity for borrowers while allowing holders to earn yield without selling their Bitcoin.

The current supply on Aave Core (Ethereum) is at 1.88k tBTC (roughly around $ 205.4 million in dollar value)

This success on Ethereum created a strong foundation to expand into additional ecosystems. With integrations now live on Base and Arbitrum, Aave is positioning itself as the leading venue for BTC collateral across multiple chains.

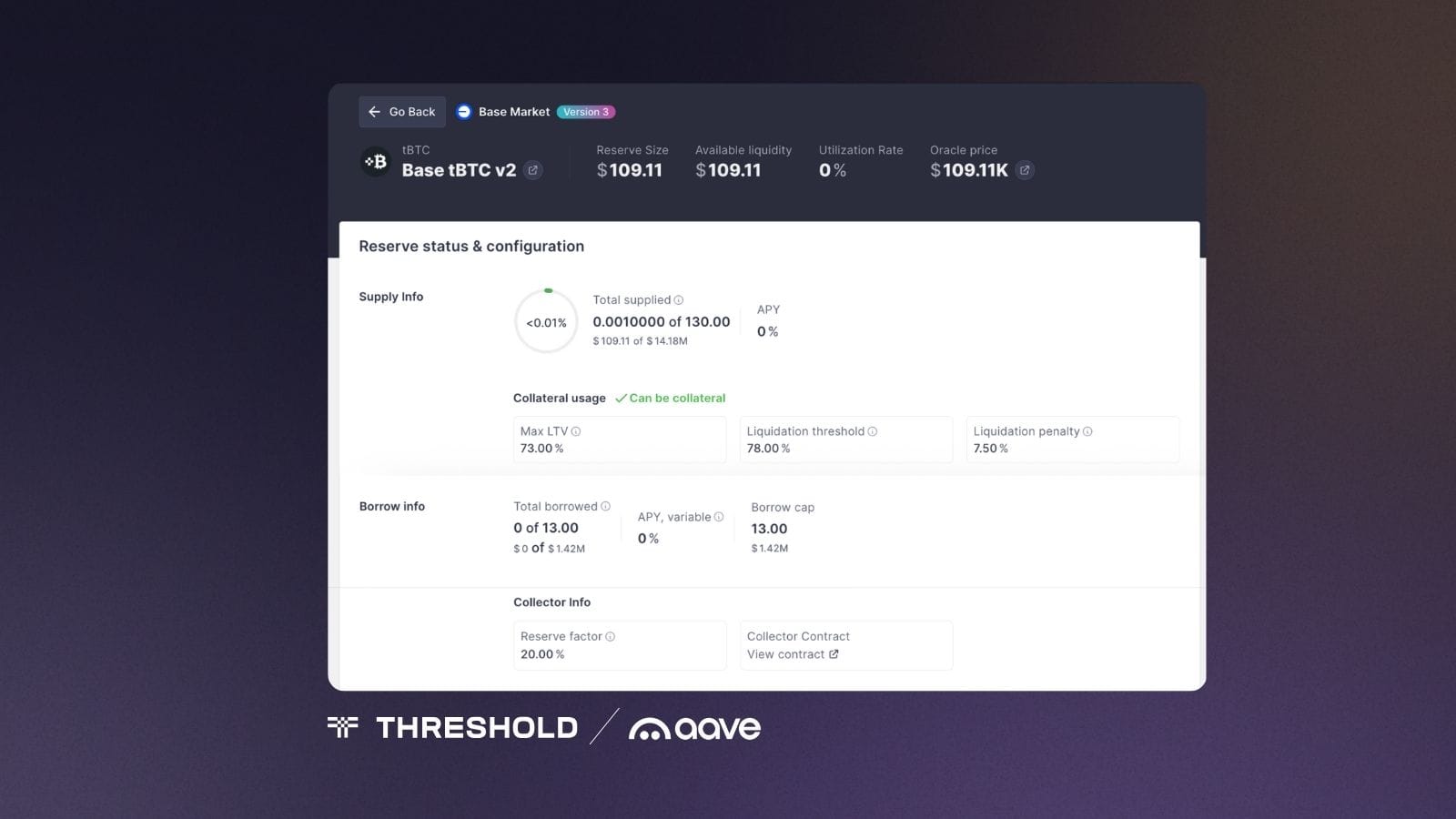

Expanding to Aave v3 Base

On Base, tBTC is now enabled as collateral with a supply cap of 130 tBTC and a borrow cap of 13 tBTC. The Loan-to-Value (LTV) ratio is set at 73% and the liquidation threshold at 78%, parameters designed to balance capital efficiency with risk management. tBTC on Base is not only collateral-enabled and borrowable but also flashloanable.

Base has quickly established itself as one of the fastest-growing networks in DeFi, with strong developer activity and significant liquidity inflows. Direct minting of tBTC is now available on Base, enabling BTC holders to seamlessly transition into the chain and immediately supply their assets to Aave. Since launch, more than 116 BTC (around $12 million) has already been supplied, a sign of early and healthy traction.

For users, this means the ability to deploy Bitcoin directly within the Base ecosystem, gaining exposure to Base-native opportunities without first converting into ETH or stablecoins.

Supply tBTC on Aave v3 Base:

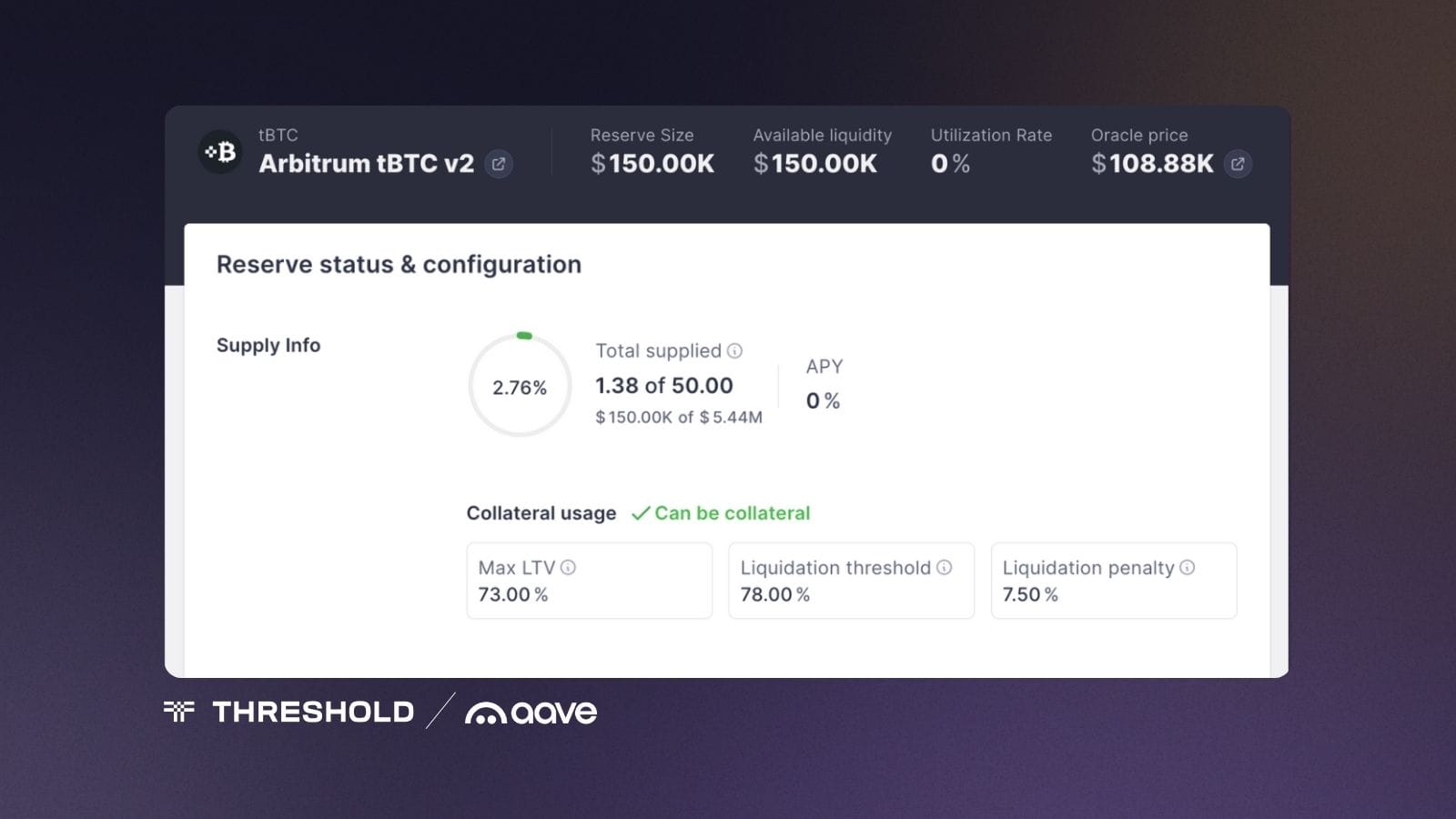

Expanding to Aave v3 Arbitrum

On Arbitrum, tBTC has also gone live, though with more conservative initial parameters. The supply cap has been set at 50 tBTC, with a borrow cap of 25 tBTC. The LTV and liquidation threshold mirror those on Base at 73% and 78%, but borrowing and flash loans are initially disabled.

This conservative setup reflects Aave’s cautious approach to risk management when onboarding new assets. It also fits well with Arbitrum’s ecosystem, which already supports one of the deepest pools of BTC liquidity in DeFi, more than 1,000 BTC secured across protocols like GMX. By adding tBTC to Aave, Arbitrum’s lending and borrowing markets are strengthened with Bitcoin as a base-layer collateral asset, ready to expand as demand grows.

Supply tBTC on Aave v3 Arbitrum:

https://app.aave.com/reserve-overview/?underlyingAsset=0x6c84a8f1c29108f47a79964b5fe888d4f4d0de40&marketName=proto_arbitrum_v3

Why tBTC Holders Should Use Aave v3

For Bitcoin holders seeking to maximize asset utilization, Aave provides one of the most compelling venues in DeFi. The adoption of tBTC on Ethereum already proved that there is strong and consistent demand to use Bitcoin as collateral. With new deployments on Base and Arbitrum, holders now have the flexibility to choose the network that best matches their strategy—whether it’s the deep liquidity of Ethereum, the speed and cost efficiency of Base, or the established ecosystem strength of Arbitrum.

tBTC is already integrated across leading protocols, including Compound, GMX, EigenLayer, Synthetix, Morpho, and Symbiotic. On Arbitrum specifically, tBTC has native minting, is live on GMX, and is backed by sticky liquidity for liquidations.

By supplying tBTC to Aave v3, holders can borrow stablecoins or other assets while keeping their long-term exposure to Bitcoin. This unlocks capital efficiency and enables strategies such as leveraged staking, liquidity provision, or simply holding stablecoins against BTC positions. Crucially, all of this happens within Aave’s carefully designed risk framework, which employs conservative supply caps, LTV ratios, and liquidation thresholds to maintain system stability.

Beyond lending and borrowing, Aave sits at the center of the onchain financial ecosystem. Integrating tBTC doesn’t just create access to credit—it connects Bitcoin to a broad range of DeFi opportunities, from derivatives to restaking, making Aave the most comprehensive venue for BTC collateralization today.

Strengthening the BTCFi Stack

The addition of tBTC to Aave v3 Base and Arbitrum builds on Ethereum’s momentum and broadens Bitcoin’s role in onchain markets. These integrations increase the diversity of collateral on Aave, expand the set of options available to BTC holders, and strengthen the foundation of the emerging BTCFi economy across multiple chains.

With tBTC on Aave, it can power lending markets, provide liquidity, and serve as trusted collateral across Ethereum, Base, and Arbitrum.For users, the opportunity is clear: bring your BTC onchain with tBTC and let Aave unlock its full potential.

About Threshold Network

Threshold Network is the decentralized protocol behind tBTC, a fully non-custodial, 1:1 Bitcoin-backed asset secured by a 51-of-100 threshold signer model. tBTC enables native BTC to move across chains like Ethereum, Base, BOB, and Arbitrum without requiring custodians or compromising security.

With over $700M in TVL and over $3.8B in bridge volume, Threshold offers the most battle-tested, trust-minimized Bitcoin infrastructure in DeFi. Learn more at threshold.network