Stake, Earn, Repeat: tBTC Pool is Officially Live on Yield Basis

Protected BTCFi strategies: tBTC integrates with Yield Basis to mitigate impermanent loss (IL) risk via 2x leverage mechanics. | Threshold Network

Protected BTCFi strategies: tBTC integrates with Yield Basis to mitigate impermanent loss (IL) risk via 2x leverage mechanics.

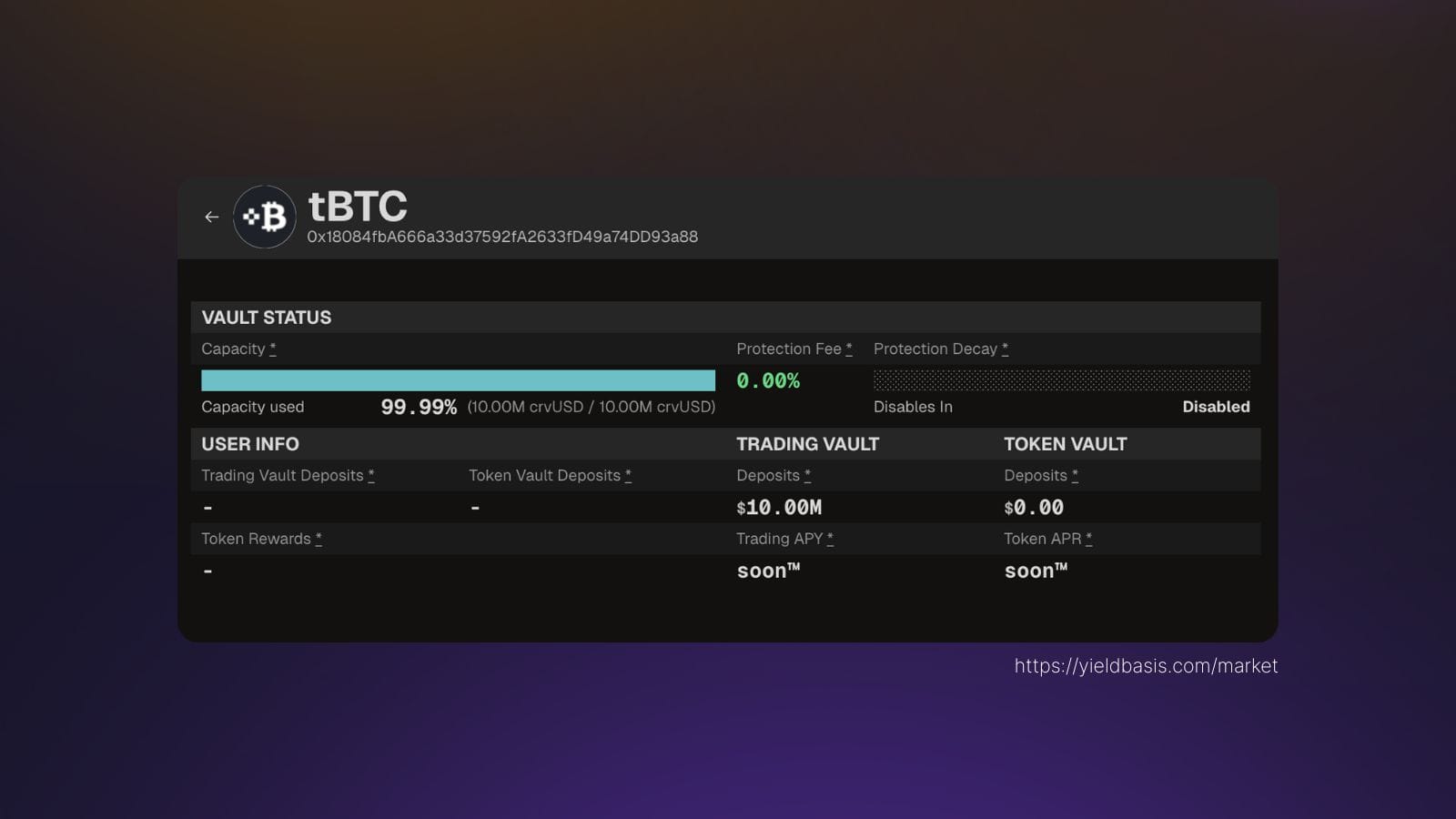

As of initial launch day September 1, $1M was immediately deposited into the tBTC pool, which ended the week at an APY of 146.54%, the highest across all BTC wrappers on Yield Basis (Markets Dashboard).

Summary in Brief

In every gold rush, traders pursue speculative gains, while liquidity providers supply the infrastructure that enables markets to function. Unlike merchants of the past whose tools retained value, liquidity providers today face impermanent loss, which erodes capital during periods of high activity.

Threshold Network announces its integration with Yield Basis to address this structural problem. As soon as the pools reopen, tBTC holders can participate as protected liquidity providers: participants whose capital is maintained through automated mechanisms, regardless of market volatility.

BTCFi Innovation: Automated Leverage with Mitigated Liquidation Risk

tBTC’s integration with Yield Basis represents a significant advancement in Bitcoin liquidity design. Through overcollateralization and automated rebalancing, the protocol maintains position value while applying 2x leverage mechanics within Curve’s BTC wrapper–crvUSD liquidity pools.

Unlike traditional leveraged positions, which face liquidation during volatility, Yield Basis applies a 200% collateralization ratio and automatically rebalances before liquidation thresholds are reached. This mechanism preserves position value without requiring manual intervention, materially reducing liquidation risk.

This innovation introduces a new primitive for BTCFi: access to leverage while employing mathematical safeguards to mitigate the downside risk typically associated with such positions.

Why tBTC is the Optimal Asset for Protected BTCFi Strategies

Not all forms of Bitcoin in DeFi provide equal assurances. The choice of underlying asset is critical:

- Custodial Wrapped Bitcoin: Single points of failure. BitGo controls WBTC. Coinbase controls cbBTC. One custodian, one concentrated risk.

- tBTC: Secured by threshold cryptography across a distributed network of nodes. No single entity can freeze, seize, or compromise the underlying Bitcoin. In operation for five years, processing ~$2.7 billion in volume with zero security incidents.

When building protected liquidity positions, infrastructure security is foundational. Yield Basis protects against impermanent loss, while Threshold’s decentralized custody architecture eliminates centralized custody risk. Together, they enable comprehensive protection for advanced BTCFi strategies.

Understanding Protected Liquidity Provision

Casinos operate on predictable mathematical certainty. Their edge is systematic, not speculative. Every game is structured to ensure consistent profitability.

Traditional liquidity provision breaks this model. LPs enable trading but suffer impermanent loss when volatility increases. It is equivalent to operating a casino where the chips themselves lose value during peak demand.

With Yield Basis protection, the model changes. For example: a $100K tBTC liquidity position that would otherwise incur ~5.7% impermanent loss if Bitcoin doubles (Coingecko IL Calculator) is instead preserved under normal market conditions. Automatic rebalancing maintains the position’s value while facilitating increased trading activity. In this structure, liquidity providers retain the systemic edge.

The BTCFi Vision: From Bridging to Yield Infrastructure

tBTC was originally launched as a decentralized bridge, enabling Bitcoin to move across chains without centralized custodians. That was the first step. The broader vision is to make Bitcoin fully functional within DeFi, not only for transfers, but also as productive collateral in sophisticated yield strategies.

The Yield Basis partnership exemplifies this progression. Protected liquidity provision demonstrates how Bitcoin can operate productively without compromising security. The same infrastructure that secures cross-chain transfers now underpins strategies designed to minimize impermanent loss risk.

Threshold’s BTCFi thesis is clear: Bitcoin should serve as pristine collateral across all financial primitives. Not only for bridging, not only for holding, but for full-scale participation in financial markets with uncompromised security.

How to Access Protected tBTC Strategies with Yield Basis

Campaign Timeline

- August 25: Curve DAO vote opens (7-day voting period)

- September 1: Vote closes, deposits open with $1M initial cap

- October 2: Second deposit opens with $10M cap (then later on opens to further deposits)

- Post-launch: Expansion to Arbitrum, Fraxtal, Optimism, and Sonic

- Ongoing: Continuous liquidity provision with automated protection

Mechanics

- Protocol fees: Trading fees are distributed based on volume.

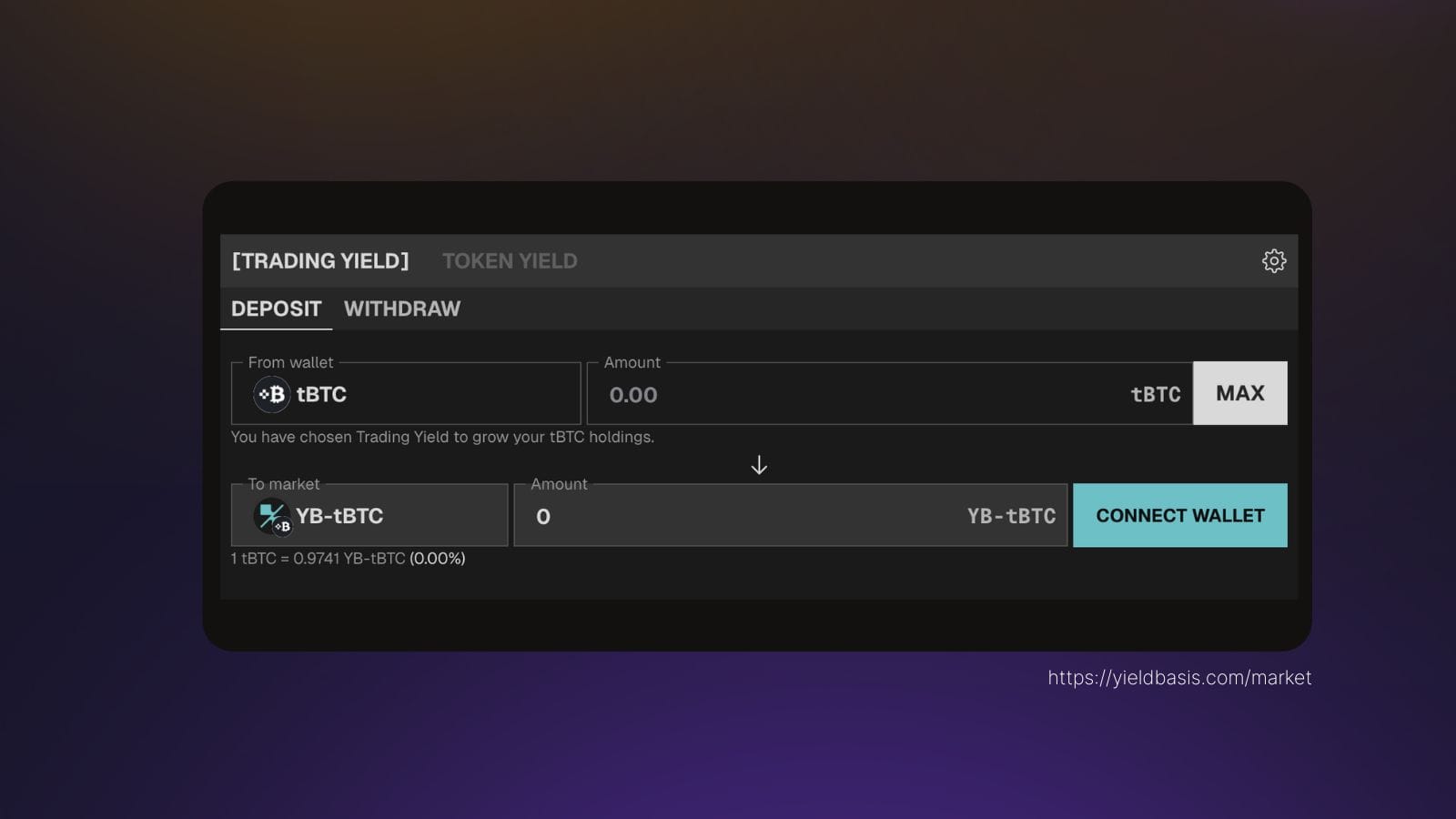

- Token design: Depositors receive ybBTC, a yield-bearing token representing their protected position, enabling advanced looping strategies.

- Deposit conversion: All BTC wrapper deposits (including tBTC) convert to ybBTC.

- Leverage: Positions target 2x exposure, with automatic rebalancing to maintain the ratio.

- Rebalancing incentives: Arbitrage ensures collateralization remains intact without user intervention.

- Protection: Impermanent loss offset via leverage adjustment.

Example: A $100,000 tBTC deposit targets $200,000 in value through leverage. As prices fluctuate, automatic rebalancing sustains the ratio and preserves position value.

Yield Basis deploys deposited tBTC into Curve BTC wrapper–crvUSD pools. Users deposit tBTC only; all LP operations, borrowing, and debt repayment are automated. At present, the tBTC pool has $10M in deposits, opening up for further deposits via (Yield Basis Markets).

How to Participate

- Hold tBTC (mint at the Threshold Dashboard if required) https://yieldbasis.com/market/0x2B513eBe7070Cff91cf699a0BFe5075020C732FF

- From October 2, access Yield Basis via https://yieldbasis.com/markets

- Deposit tBTC into protected liquidity pools.

- Participate in advanced BTCFi strategies with IL mitigation mechanisms.

As BTCFi matures from experimental applications into institutional infrastructure, participants face a choice: to chase speculative gains or to establish durable positions in the infrastructure itself.

Risk Considerations

Yield Basis has completed six security audits, including one by Quantstamp. However, all DeFi protocols carry risk. Participants should consider:

- Smart contract vulnerabilities

- Oracle dependency

- Protocol governance changes

- Gas costs and network performance

- General market volatility

Initial deposits are capped at $10M across all BTC wrappers. As always, only commit capital you can afford to lose.

This partnership enables tBTC holders to contribute as infrastructure providers. To build lasting positions in Bitcoin’s financial system with mechanisms designed to preserve capital.

Protected Bitcoin liquidity is now live. The question is whether to participate as a prospector, or as a merchant.

The tBTC x Yield Basis pool officially opens today, October 2, 2025.

Stay connected: Follow @TheTNetwork, @tBTC_project, and @yieldbasis on X. Join our Discord for updates.

Disclaimer: The information provided is for informational purposes only and does not constitute financial, investment, or legal advice. Digital asset investments carry significant risk. Conduct independent research and consult licensed advisors before making investment decisions.