Unlocking Liquidity: Threshold Launches Bond Program with Bond Protocol

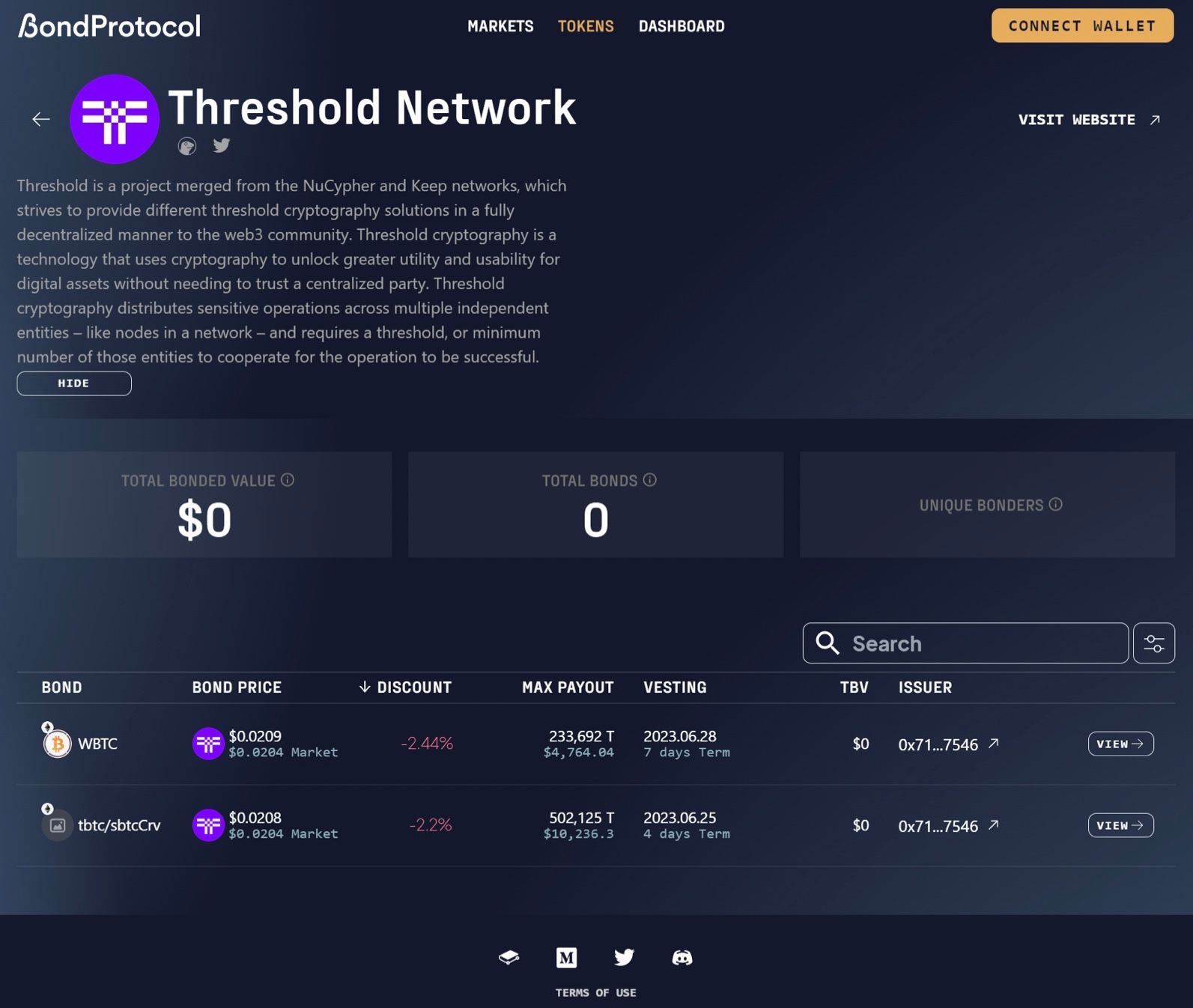

As part of Threshold’s efforts to increase awareness and usage of tBTC, today we launch our first bonding program, which allows people to swap tokens they hold (e.g., WBTC or Curve LP tokens) for discounted Threshold work tokens (T) that are delivered after a period of time (the maturity of the bond). This process is managed by the Bond Protocol in a trust-minimized manner.

Benefits to token holders include the ability to acquire T tokens at a discount (these allow the holder to participate in Threshold governance and may also be staked to run the Threshold Network and for providing liquidity, both of which earn rewards). Threshold Network benefits from increased market liquidity for the work token via Protocol Owned Liquidity, which is preferred over paying to rent liquidity that can vanish as providers chase higher yield elsewhere.

An Introduction to Bond Protocol

In the world of decentralized finance (DeFi), protocols face the ongoing challenge of strengthening their treasuries and navigating the ever-changing landscape of fundraising and liquidity provisioning. This is where Bond Protocol emerges as a solution, empowering protocols to diversify their treasuries, fund growth initiatives, and fortify their financial foundations.

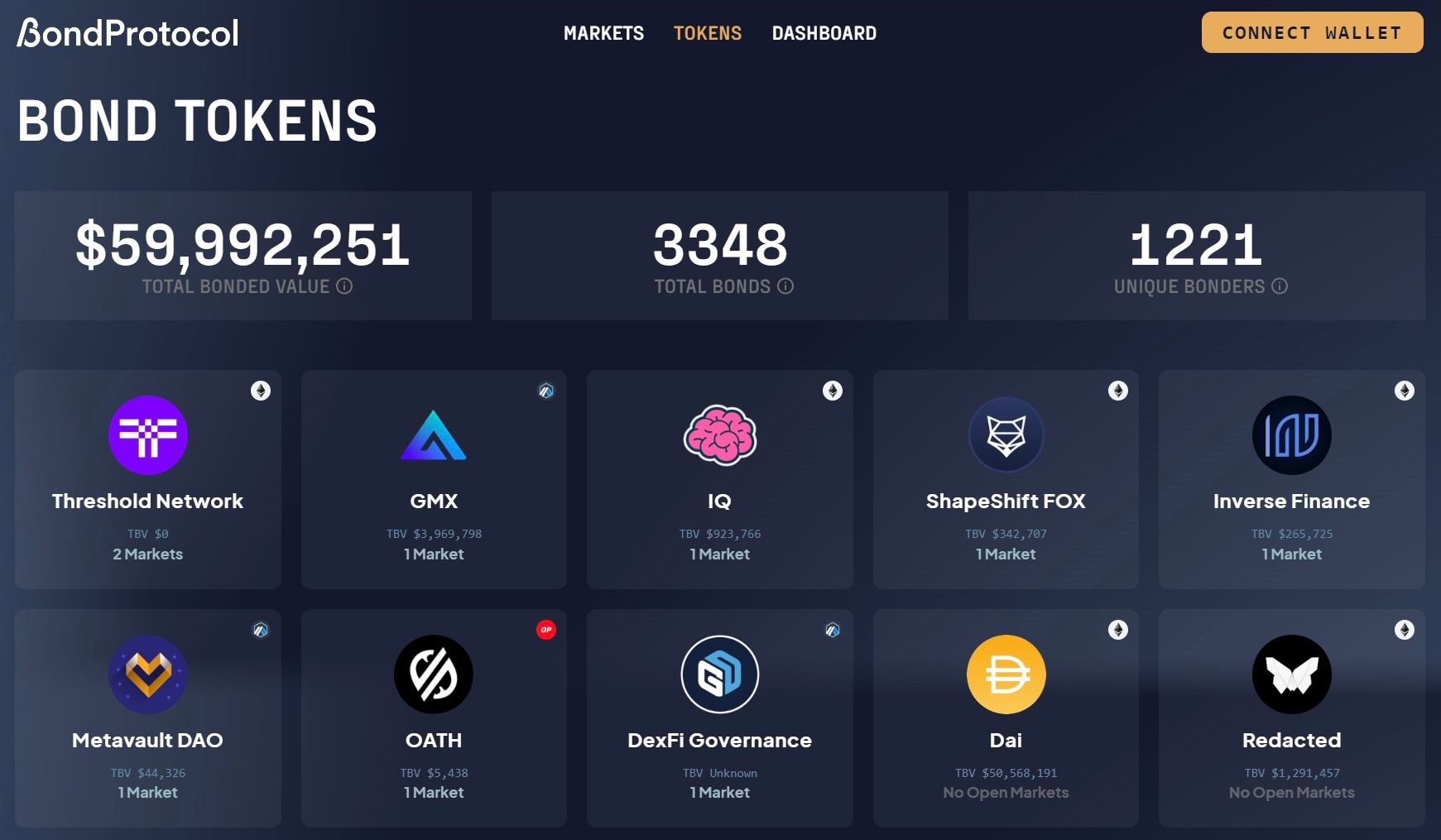

Bond Protocol revolutionizes the traditional fundraising model by providing permissionless bond marketplaces, where issuers can easily deploy a bond market and offer tokens at set or variable exchange rates for other ERC-20 tokens or liquidity pool tokens. Other key features include composability of Bond Tokens for secondary markets and a modular framework for flexibility and adaptability. Since launch in October 2022, Bond Protocol has facilitated ~$60M total-bonded-value (TBV) and has been utilized by over 20 protocols.

TIP 47 - Liquidity Bootstrappening Part 2: PCV

Threshold Improvement Proposal 47 is part of a series of three proposals the community approved to bootstrap tBTC liquidity. TIP 47 authorized the Threshold Bond Program to help the Threshold Treasury Guild (TTG) continue to grow tBTC liquidity and further diversify Threshold’s Treasury.

- TIP 46: Defi Liquidity Bootstrap and Growth Part I - Market Maker

- TIP 47: Liquidity Bootstrappening Part 2: PCV (Governor Bravo)

- TIP 48: Liquidity Bootstrappening Part 3: Threshold DAO x Wormhole

Named Liquidity Bootstrappening Part 2 - Protocol Controlled Value (PCV), the aim is to enhance tBTC liquidity and establish essential protocol-owned liquidity (POL) rooted in the oldest and largest crypto-asset, Bitcoin. The plan involves multiple phases to create a DeFi revenue flywheel owned by the Threshold DAO and managed by the TTG.

Unlocking Liquidity: Threshold Launches Bond Program with Bond Protocol

The effort begins with two different Bond market options: a Curve LP Bond market and a WBTC Bond market. Liquidity providers are offered the opportunity to bond their positions for T, utilizing Bond Protocol as a permissionless platform for the exchange. Subsequent phases of the program will be developed and rolled out by the TTG with guidance from the Bond Protocol team. Threshold DAO approved a budget that will be managed and reported on a monthly basis by the Treasury Guild. The allocated funds include 10M T tokens for vote incentives on platforms like Votium and 40M T for direct purchase of BTC-denominated Protocol Controlled Value (PCV), with flexibility to adjust investments as needed.

In October of 2022, we published “Three Pillars of DAO Treasury Management”, and while some of the information has changed, such as tBTC being live and generating revenue for the protocol, the overall goals and pillars of the Threshold DAO’s Treasury Management and the TTG’s strategy remain the same. We are excited to explore how bond programs can become another tool for furthering these goals.

On Friday, June 9th, Threshold DAO contributors hosted a Twitter Space AMA with Bond Protocol to discuss the Threshold Bond Program, the Threshold Treasury Guild’s goals, and how the Threshold Bond Program will help us achieve our ambitious treasury goals. The Space was recorded and is available for replay on Twitter.

To participate in the Threshold Bond Program, visit the Bond Protocol dApp. If you have questions, both communities are available on Discord. We invite everyone to join our communities on the Threshold Discord and the Bond Protocol Discord. To keep up with the latest Threshold news, follow Threshold on Twitter and subscribe to the Threshold Time newsletter.