tBTC v1 to v2 Migration Roadmap

We have a v1 to v2 migration proposal. Agoristen’s “The Sunsettening” was validated unanimously with 1.3B T in favor, and it’s now time to start implementation. The Sunsettening means that existing tBTC v1 will be upgraded to tBTC v2 and then changed back to v1 by the DAO after launch of the bridge. This has several advantages: tBTC will not only continue to operate and preserve its commitment to decentralization, but, as structured in the proposal, also avoid any losses for the last standing node operators and tBTC holders.

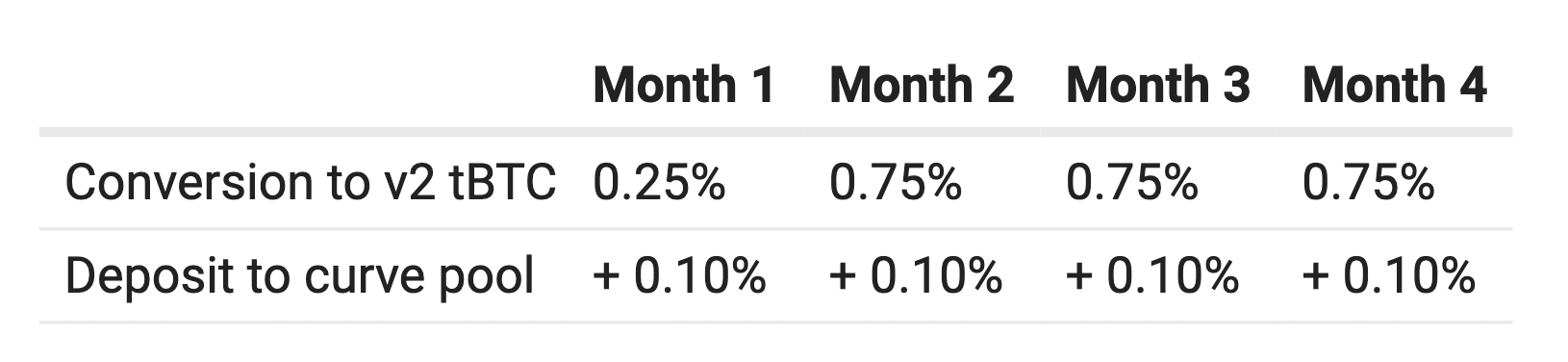

The incentive structure to encourage migration from v1 to v2 can be found below.

Rewards distribution

(Further information on rewards eligibility and distribution can be found in the proposal as well as summarized in the appendix at the end of the post).

The implementation of this proposal has five sequential steps:

- Sortition Pool Deauth

- Call for Redeemer

- Redeemer Designation & Flag Day Schedule

- Flag Days

- Dealing With Remaining v1 tBTC

Let’s now walk through the details of each step.

Sortition Pool Deauth

The first thing that needs to happen is for a majority of all node operators to deauthorize the sortition pool. This is to prevent the minting of new tBTC and is a prerequisite for redemptions to occur. Instructions on how to deauth can be found here.

To incentivize node operators, the DAO will cover all ETH losses that occur as a result of the sunsetting. It’s important to note that node operators who do not deauth will not be reimbursed for any losses.

Call for Redeemer

Following a majority of node operators deauth’ing, the next step can begin: designating a redeemer who will use their own funds in assisting in the redemption process of all BTC lots.

The redeemer must have the have the following characteristics:

- At least 30 BTC (+ fees) available, but ideally 50-100 BTC.

- Accepted in good standing as solely determined by the DAO treasury.

Agoristen, the proposal author, has made himself available as a redeemer citing the following:

- Sufficient BTC available to complete the job.

- A reputation as having performed large quantities of redemptions in the past and having been hired by several community members to perform redemptions.

- A proposal to act as a redeemer for gas/fee costs +0.25% premium. To redeem 670 BTC, this would represent a profit of 1.675 BTC (as the DAO will cover gas fees).

In order to provide a fair opportunity for more attractive bids from other community members who are sufficiently equipped to perform the role of the redeemer, there’s an open opportunity for others to submit competing bids.

Redeemer Designation & Flag Day Schedule

Upon the decision of the DAO treasury, the redeemer will be publicly announced in addition to a flag day schedule.

So what are flag days? Flag days are designated days where redemptions will occur over a defined period of time. These days will be announced well in advance for the purpose of encouraging as many node operators as possible to be available. On these days, Keep will be available to ensure smooth redemption processes for all and minimize losses.

Flag Days

On specified flag days, the redeemer will perform redemptions based on lot size and collateral. Larger lots (10 BTC) that have a high collateral ratio will be prioritized for redemption first in order to minimize operator losses. The process is as follows:

As tBTC v1 is redeemed, the redeemer will deposit the resulting BTC into the v2 bridge and mint v2 tBTC, these will be moved through the vending machine, back to v1, which is then subsequently redeemed. The process is repeated until the vending machine is emptied.

Following the conclusion of the flag day schedule, there will likely be a small amount of tBTC left.

Dealing With Remaining v1 tBTC

How to deal with this remaining amount of tBTC depends on the amount left. If it’s a negligible amount,

the remaining node operators can collaborate to seize the BTC outright, transfer it to v2, then take the loss of ETH collateral which is refunded by the DAO.

However, if a significant amount is left over, Agoristen’s proposal lays out a process for this scenario.

The Keep multisig can organize to reduce collateral requirements to 101%, a group of 3 community members and/or Keep team will initiate one node each with the minimum KEEP stake (10k KEEP) and sufficient ETH stake and the redeemer will then churn to reduce the collateral ratio to 101%. Finally this group will seize remaining BTC (at very little cost that is refunded by the DAO) and transfer it to v2.

Seizure of any amount of funds will be fronted by the DAO making a deposit into v2 to ensure that tBTC is always fully collateralized such that tBTC v1 pairs and DeFi protocols will operate unaffected by the migration.

Once this process is complete, tBTC v1 can be sunset.

Appendix

On rewards distribution

- The eligibility for rewards distribution is limited to net inflow of tBTC v1 to the vending machine to avoid attempts at gaming the system (i.e. grabbing tBTC from the curve pool and converting to v1 then back to v2). To receive rewards, funds cannot be converted back to v1 at any time. This rule applies to multiple addresses as well.

- To ensure you receive rewards simply convert from v1 to v2 and leave the funds in that address untouched or deposit to the curve pool.

- Following the launch of the v2 bridge, rewards will be distributed.

- The distribution of rewards will be facilitated by a private form accessible through TOR.

- In the form, users will submit a signature from their ETH address signing tx hash of their deposit into the vending machine and optionally the tx hash of their deposit into the curve pool). The DAO treasury will validate that their claim is correct and proceed to transfer tBTC v2 rewards to their ETH address. There will be a deadline to submit of 3 months.